Metal Recycling and Recovery Market Size to Hit USD 957.06 Billion by 2035

According to Towards Chemical and Materials, the global metal recycling and recovery market size reached at USD 571.57 billion in 2025 and is expected to hit around USD 957.06 billion by 2035 at a CAGR of 5.29% from 2025 to 2035.

Ottawa, Nov. 21, 2025 (GLOBE NEWSWIRE) -- The global metal recycling and recovery market size was valued at USD 571.57 billion in 2025. The market is projected to grow from USD 601.80 billion in 2026 to USD 957.06 billion by 2035 at a CAGR of 5.29% during the forecast period. North America dominated the metal recycling and recovery market with a market share of 43% in 2024. The Metal Recycling and Recovery Market is growing due to rising demand for sustainable and cost-effective raw materials across major industries such as automotive, construction, electronics, and packaging. A study published by Towards Chemical and Materials a sister firm of Precedence Research.

Download a Sample Report Here@ https://www.towardschemandmaterials.com/download-sample/6007

What is Metal Recycling and Recovery?

The Metal Recycling and Recovery Market is experiencing strong global growth driven by increasing industrial demand for sustainable, cost-efficient, and high-quality recycled metals. Rising scrap generation from sectors such as automotive, construction, electronics, and manufacturing continue to strengthen the supply base for recycling operations.

The rapid adoption of electric vehicles and renewable energy technologies has further elevated the importance of recovering critical metals like lithium, cobalt, nickel, and rare earth elements. Governments worldwide are implementing strict environmental regulations and circular economy policies, encouraging industries to reduce waste and rely more on recycled materials.

Metal Recycling and Recovery Market Report Highlights

- By region, Asia Pacific dominated the metal recycling and recovery market with approximately 43% industry share in 2024.

- By region, North America is likely to capture a greater portion of the market in the future.

- By metal type, the ferrous metal segment dominated the market with approximately 58% in 2024.

- By metal type, the battery and critical metals segment is expected to grow at a 9% CAGR in the market during the forecast period.

- By process, the mechanical processing & sorting segment dominated the metal recycling and recovery market with approximately 41% industry share in 2024.

- By process, the hydrometallurgical/chemical recovery segment is expected to grow at the fastest rate in the market during the forecast period.

- By end use, the automotive segment dominated the market with approximately 31% industry share in 2024.

- By end use, the aerospace and defense segment are expected to grow at a 7% CAGR in the market during the forecast period.

Request Research Report Built Around Your Goals: sales@towardschemandmaterials.com

AI Driving Efficiency and Innovation in the Metal Recycling and Recovery Industry

AI is transforming the metal recycling and recovery industry by enabling smart sorting systems that identify and separate different metals with unprecedented speed and accuracy. Machine learning algorithms optimize recycling processes, improving yield while reducing energy consumption and operational costs. Predictive analytics help facilities anticipate equipment failures and streamline maintenance schedules, minimizing downtime and enhancing productivity.

Read More news : Metal Recycling Market Size to Worth USD 1,071.11 Billion by 2034

Why choose our scrap metal recycling services?

Selecting our services is a strategic decision that positions your business as a leader in efficiency and sustainability. Your business is not just a participant but a leader in the transition to a sustainable future. Place your trust in our expertise, and together, we will transform waste into worth, achieving remarkable results that resonate beyond profit and foster a cleaner and more prosperous world for generations to come.

Contact us today for a professional consultation and to align your business operations with the pinnacle of sustainability. Our team of experts is ready to assist you with strategic scrap metal collection and disposal solutions, ensuring your business contributes positively to the industry.

Please contact us directly to learn more about our comprehensive services and how they can benefit your company. Together, we can forge a future a few shades greener.

Global Metal Recycling Statistics

The worldwide metal waste recycling industry processes tremendous volumes of scrap metal annually.

Geographic Distribution

Several countries lead in the volumes of metal recycling:

- United States: Processes 85 million metric tonnes of scrap metal annually

- United Kingdom: Generates 10-11 million metric tonnes of scrap metal yearly

- European Union: Advanced sorting infrastructure has been developed across Germany, France, and the Nordic countries

- Asia-Pacific: China, Japan, and South Korea lead regional processing capacity

Growth trends in metal recycling have shown consistent expansion over the past decade, largely driven by companies placing greater emphasis on their ESG commitments and embracing circular economy principles. Industry analysts project that recycling capacity will continue to increase through 2030, fueled by rising global populations and the accelerating generation of electronic waste streams.

Private Industry Investments in the Metal Recycling and Recovery Industry:

- 2150's investment in METYCLE: The venture capital firm led a $15 million funding round for METYCLE to help the company modernize the global metal recycling trade using advanced technology.

- Corporate partnership between Nupur Recyclers and HeiTec Rohstoffe: The two companies formed a partnership to strategically outsource and recycle leftover raw materials, expanding their global metal recycling and processing businesses.

- Nupur Recyclers' acquisition of Frank Metals Recyclers: Nupur Recyclers acquired an 80% stake in Frank Metals Recyclers to expand its business in trading and recycling ferrous and non-ferrous metal scrap.

- Pondy Oxides & Chemicals Ltd (POCL) capacity expansion: POCL, a manufacturer of lead metal and alloys, is investing to expand its lead capacity by 72,000 MTPA.

-

Attero's investment in rare earth recycling: Attero is investing ₹100 crore to increase its capacity for recycling rare earth materials, leveraging its patented technology.

Immediate Delivery Available | Buy This Premium Research Report@ https://www.towardschemandmaterials.com/checkout/6007

Metal Recycling Equipment Market Report Scope

| Report Attribute | Details |

| Market size value in 2026 | USD 601.80 Billion |

| Revenue forecast in 2035 | USD 957.06 Billion |

| Growth rate | CAGR of 5.29% from 2025 to 2035 |

| Historical data | 2020 - 2025 |

| Forecast period | 2025 - 2035 |

| Segments covered | By Metal Type, By Process / Technology, By End-Use Industry, By Region |

| Country scope | U.S.; Canada; Mexico; Germany; France; U.K.; Italy; Spain; China; India; Japan; South Korea; Australia; Brazil; Argentina; Saudi Arabia; UAE |

| Key companies profiled | Sims Limited (Sims Metal Management), Schnitzer Steel Industries, Nucor Corporation, Steel Dynamics, Inc., Novelis Inc., Alcoa Corporation, Umicore, Aurubis AG, Boliden, European Metal Recycling (EMR), Li-Cycle Corp., Redwood Materials, |

Read More news : U.S. Metal Recycling Market Size to Cross USD 121.04 Bn by 2034

For more information, visit the Towards Chemical and Materials website or email the team at sales@towardschemandmaterials.com| +1 804 441 9344

What are the Key Trends of the Metal Recycling and Recovery Market?

-

Technological Advancements in Sorting and Processing

The industry is experiencing a significant shift from manual sorting to advanced, automated systems that increase efficiency and purity of recovered metals. Innovations like AI-powered optical sorting, Laser-Induced Breakdown Spectroscopy (LIBS), and X-ray Fluorescence (XRF) allow for precise identification and separation of complex metal alloys and contaminants, even in mixed waste streams like e-waste.

-

Integration of Circular Economy Principles and Regulation

A strong global push for sustainability and stricter environmental regulations is driving the adoption of circular economy models that emphasize reuse and regeneration over primary extraction. Governments are implementing policies, such as mandatory recycling targets and Extended Producer Responsibility (EPR) programs, which incentivize manufacturers to use recycled content and develop closed-loop supply chains.

-

Growing Demand from Green Energy and E-Waste Sectors

The transition to clean energy sources, including electric vehicles (EVs), wind turbines, and solar panels, has created substantial new demand for specific metals like lithium, cobalt, copper, and aluminum. This trend has also spurred growth in the specialized field of "urban mining," which focuses on recovering these valuable and rare earth elements from the rapidly growing stream of electronic waste.

Market Opportunity

The Battery Metals Boom: Unlocking the Next Big Opportunity in Global Recycling

A major opportunity in the Metal Recycling and Recovery Market lies in the rapidly expanding demand for battery and critical metal recycling, driven by the global shift towards electric vehicles, renewable energy storage, and advanced electronics. As EV adoption accelerates worldwide, the need for secure, sustainable, and cost-effective sources of lithium, cobalt, nickel, and manganese is increasing faster than primary mining can support. This creates strong incentives for recycling companies to invest in advanced hydrometallurgical, pyrometallurgical, and direct recycling technologies capable of extracting high-purity metals from end-of-life batteries and production scrap.

Immediate Delivery Available | Buy This Premium Research Report@ https://www.towardschemandmaterials.com/checkout/6007

Metal Recycling and Recovery Market Segmentation Insights

Metal Type Insights

The ferrous metal segment led the market in 2024, because steel and iron represented the largest share of global scrap generation from industries such as automotive, construction, and manufacturing. Their high recyclability and low production cost made ferrous metals the most economically attractive materials to process. Strong demand for recycled steel in construction, infrastructure projects, and industrial manufacturing further boosted the segment's dominance.

The battery and critical metals segment are growing fastest over the forecast period, driven by due to the rapid surge in electric vehicles, energy storage systems, and consumer electronics that generated substantial end-of-life batteries. These batteries contain high-value metals such as lithium, cobalt, nickel, and manganese, making their recovery economically and strategically important. Growing global demand for critical minerals, driven by clean energy and electrification trends, further pushed industries to depend on recycled sources to reduce supply chain risks.

Process/Technology Insights

The mechanical processing & sorting segment led the market in 2024, because it remained the most widely adopted and cost-effective method for separating mixed metal waste at scale. Its ability to efficiently handle large volumes of scrap, using shredders, magnetic separators, and eddy current systems, made it essential for both ferrous and non-ferrous metal recovery. Growing industrial and municipal waste streams increased reliance on mechanical sorting as the first stage of the recycling chain.

The hydrometallurgical/chemical recovery segment is projected for fastest-growth over the forecast period, because it offered superior efficiency in extracting high-purity metals from complex and low-grade waste streams. Its ability to recover valuable metals such as lithium, cobalt, nickel, and rare earth elements made it essential for battery, electronics, and EV recycling. The process also produced fewer emissions and operated at lower temperatures than traditional pyrometallurgical methods, supporting sustainability goals.

End-use Industry Insights

The automotive segment led the market in 2024, because end-of-life vehicles generated large volumes of recyclable metals, creating a steady and valuable material supply. Automakers increasingly relied on recycled steel, aluminum, and copper to meet rising demand for lightweight and cost-efficient vehicle components. Environmental regulations and circular economy policies pushed manufacturers to incorporate higher percentages of recycled metals into new vehicles.

The aerospace and defence segment is the second-largest segment, leading the market, due to its heavy use of high-value metals like titanium, aluminum, and specialty alloys that are economically attractive to recycle. The industry's strict material performance requirements encouraged the use of high-purity recycled metals, which offered both cost savings and sustainability benefits. Rising aircraft production and modernization programs generated substantial scrap metal, increasing the supply available for recovery.

➤ Contact Us: sales@towardschemandmaterials.com | ☎ +1 804 441 9344

Regional Insights

Asia Pacific: The Powerhouse Shaping the Future of Metal Recycling

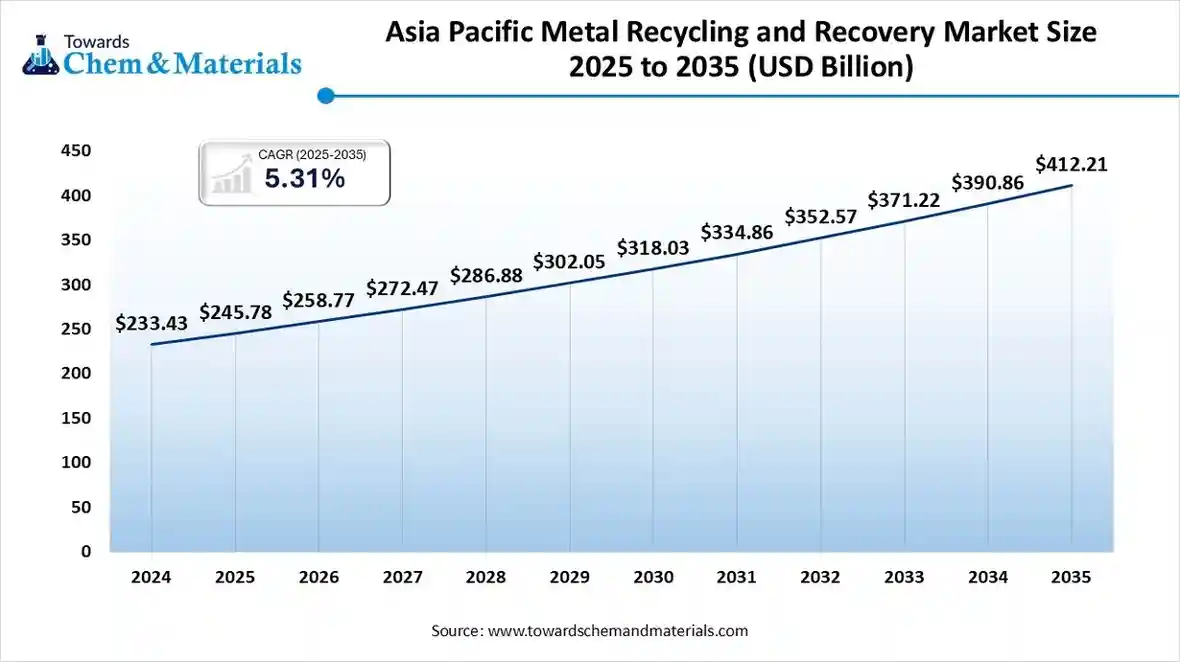

The Asia Pacific metal recycling and recovery market size was valued at USD 245.78 billion in 2025 and is expected to reach USD 412.21 billion by 2035, growing at a CAGR of 5.31% from 2025 to 2035.

Asia Pacific dominates the market due to its vast industrial ecosystem and substantial scrap generation from rapidly expanding automotive, construction, electronics, and manufacturing sectors. Massive urbanization and extensive infrastructure development across China, India, Japan, and Southeast Asia are creating strong and consistent demand for recycled steel, aluminum, and copper to support large-scale projects. The region's booming electronics and electric vehicle industries are also driving a surge in the recovery of high-value batteries and critical metals, including lithium, cobalt, nickel, and rare earth elements.

China Metal Recycling and Recovery Market Trends

China’s market is experiencing strong growth driven by the nation’s accelerated shift toward circular economy policies and strict regulations on waste reduction and resource efficiency. Rapid industrialization and the expansion of automotive, electronics, and construction sectors are generating large volumes of scrap metal, boosting demand for advanced recycling and recovery solutions.

North America Emerges as the Fastest-Growing Engine of Metal Recycling & Recovery

North America is witnessing the fastest growth in the market due to a strong push toward circular economy practices across major industrial sectors, including automotive, construction, aerospace, and electronics. The region benefits from advanced recycling technologies, such as AI-driven sorting systems, sensor-based separation, and high-efficiency shredding, that significantly improve material recovery rates and make recycled metals more competitive with virgin materials.

U.S. Metal Recycling and Recovery Market Trends

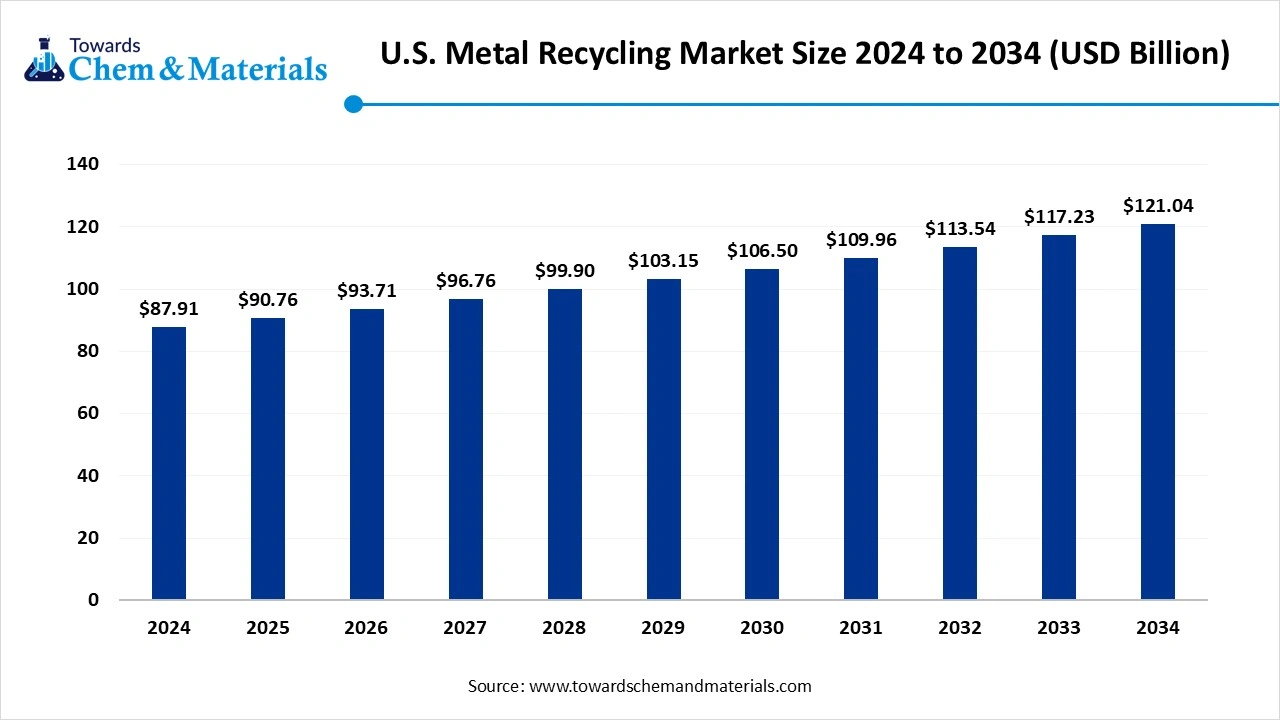

The U.S. metal recycling market size is calculated at USD 87.91 billion in 2024, grew to USD 90.76 billion in 2025, and is projected to reach around USD 121.04 billion by 2034. The market is expanding at a CAGR of 3.25% between 2025 and 2034.

The U.S. market is expanding steadily, supported by rising demand for sustainable materials, stricter waste-management regulations, and the growing emphasis on circular-economy practices. Non-ferrous metals such as aluminum, copper, and nickel are experiencing strong growth due to their essential use in electric vehicles, renewable-energy systems, construction, and advanced electronics. The industry is also being reshaped by technological advancements, including AI-based sorting, robotics, and high-efficiency separation systems that improve metal purity and reduce processing costs.

Top Companies in the Metal Recycling and Recovery Market & Their Offerings:

- Sims Limited: Globally collects, processes, and trades ferrous/non-ferrous scrap for the steel industry.

- Nucor Corporation: North America's largest steel producer, uses internal scrap subsidiaries to feed its EAF mills for low-carbon steel.

- Radius Recycling: Converts millions of tons of scrap into rebar and other steel products using an integrated recycling/manufacturing platform.

- Aurubis AG: Specializes in processing complex materials and e-waste to recover high-purity copper and other non-ferrous metals.

- Umicore: Recovers valuable metals (lithium, cobalt, PGMs) from batteries and complex waste streams to support the circular economy.

- Steel Dynamics, Inc.: Uses its OmniSource division to collect and process scrap, providing traceable raw material for its vertical steelmaking operations.

- Novelis Inc.: A world leader in aluminum rolling and recycling, supplying high-recycled content products to the auto, can, and aerospace industries via closed-loop systems

- Gerdau: Recycles 14+ million tons of steel scrap annually to produce new long steel products in its EAFs.

- European Metal Recycling (EMR): UK-based leader handling millions of tons of ferrous/non-ferrous scrap through comprehensive collection, processing, and resale services.

- Commercial Metals Company (CMC): Integrates recycling operations with steel production facilities to efficiently process scrap and create value-added steel products.

More Insights in Towards Chemical and Materials:

Metal Stamping Market : The global metal stamping market is projected to grow from USD 254.36 billion in 2025 to USD 385.66 billion by 2035, growing at a compound annual growth rate (CAGR) of 4.25% over the forecast period from 2025 to 2035.

U.S. Metal Recycling Market : The U.S. metal recycling market size is valued at approximately USD 87.91 billion in 2025 and is projected to climb to roughly USD 121.04 billion by 2034, translating into a compound annual growth rate (CAGR) of 3.25% across the period from 2025 to 2034.

Metal Recycling Market : The global metal recycling market size was valued at USD 552.19 billion in 2024, grew to USD 590.02 billion in 2025, and is expected to hit around USD 1,071.11 billion by 2034, growing at a compound annual growth rate (CAGR) of 6.85% over the forecast period from 2025 to 2034.

Asia Pacific Metal Casting Market : The Asia Pacific metal casting market size was valued at USD 85.67 billion in 2024, grew to USD 90.17 billion in 2025, and is expected to hit around USD 142.91 billion by 2034, growing at a compound annual growth rate (CAGR) of 5.25% over the forecast period from 2025 to 2034.

Metal Carboxylates Market : The global metal carboxylates market size accounted for USD 6.55 billion in 2025 and is forecasted to hit around USD 10.83 billion by 2034, representing a CAGR of 5.75% from 2025 to 2034.

Metal Casting Market : The global metal casting market size accounted for USD 152.47 billion in 2024, grew to USD 161 billion in 2025, and is expected to be worth around USD 262.91 billion by 2034, poised to grow at a CAGR of 5.60% between 2025 and 2034.

Metal-Organic Frameworks Market : The global metal-organic frameworks market volume was reached at 55,000.0 tons in 2024 and is expected to be worth around 3,43,966.3 tons by 2034, growing at a compound annual growth rate (CAGR) of 20.12% over the forecast period 2025 to 2034.

U.S. Metallocene LDPE Market : The U.S. metallocene ldpe market volume was reached at 350.00 thousand tons in 2024 and is expected to be worth around 669.44 thousand tons by 2034, growing at a compound annual growth rate (CAGR) of 6.70% over the forecast period 2025 to 2034.

Mechanical Recycling of Plastics Market : The global Mechanical Recycling Of Plastics Market is expected to reach a volume of approximately 54.87 million tons in 2025, with a forecasted increase to 120.26 million tons by 2034, growing at a CAGR of 9.11% from 2025 to 2034.

Mechanical Recycling of Plastics Market : The global mechanical recycling of plastics market size is calculated at USD 41.40 billion in 2025 and is expected to reach USD 92.86 billion by 2034, growing at a CAGR of 9.39% from 2025 to 2034.

Microplastic Recycling Market : The global microplastic recycling market size was reached at USD 325.19 million in 2024 and is expected to be worth around USD 817.00 million by 2034, growing at a compound annual growth rate (CAGR) of 9.65% over the forecast period 2025 to 2034.

Mechanical & Chemical Recycling of Polyethylene Market : The global mechanical & chemical recycling of polyethylene market size was estimated at USD 17.35 billion in 2024 and is predicted to increase from USD 19.14 billion in 2025 to approximately USD 46.20 billion by 2034, expanding at a CAGR of 10.29% from 2025 to 2034.

Oilfield Chemicals Market : The global oilfield chemicals market is projected to grow from USD 33.85 billion in 2025 to USD 53.38 billion by 2035, growing at a compound annual growth rate (CAGR) of 4.66% over the forecast period from 2026 to 2035.

Chemical Informatics Market : The global chemical informatics market is projected to grow from USD 4.85 billion in 2025 to USD 20.94 billion by 2035, growing at a compound annual growth rate (CAGR) of 15.75% over the forecast period from 2026 to 2035.

Industrial Coatings Market : The global industrial coatings market is projected to grow from USD 117.13 billion in 2025 to USD 176.06 billion by 2035, growing at a compound annual growth rate (CAGR) of 4.16% over the forecast period from 2026 to 2035.

Industrial Absorbent Market : The global industrial absorbent market size is calculated at USD 5.43 billion in 2025 and is predicted to increase from USD 5.68 billion in 2026 and is projected to reach around USD 8.56 billion by 2035, The market is expanding at a CAGR of 4.65% between 2026 and 2035.

Refractory Material Market : The global refractory material market is expected to grow from USD 31.84 billion in 2025 to USD 49.68 billion in 2035 at a CAGR of 4.55% over the forecast period.

Metal Recycling and Recovery Market Top Key Companies:

- Amcor plc

- Sealed Air

- Tetra Pak

- Huhtamaki Oyj

- Mondi

- DS Smith

- Atlantic Packaging

- ProAmpac

- Constantia Flexibles

- Genpak

- Crown Holdings, Inc.

- Gerresheimer AG

- Stora Enso

- WestRock Company

- NEFAB GROUP

- Scholle IPN

- Greiner Packaging

- Ball Corporation

- Oji Holdings Corporation

- Ardagh Group S.A.

- RAFESA

- Trivium Packaging

- Envases Group.

Recent Developments

- In June 2025, Mitsubishi Corporation announced its investments and enter into a business partnership with DEScycle Ltd., a UK company in the development of innovative Metal Recycling Technology. DEScycle's proprietary technology enables the selective removal of metals at room temperature.

- In April 2025, The Nobian, Asahi Kasai, Furuya Metal, and Mastermelts established a strategic collaboration. The main motive behind the collaboration is to recycle metals from the electrolyzer compounds, as per the company's published report.

Metal Recycling and Recovery Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2019 to 2034. For this study, Towards Chemical and Materials has segmented the global Metal Recycling and Recovery Market

By Metal Type

- Ferrous Metals (Steel & Iron)

- Aluminum

- Copper

- Lead

- Precious Metals (Gold, Silver, Platinum group)

- Battery & Critical Metals (Lithium, Cobalt, Nickel, Rare Earths)

- Others (Zinc, Tin, Magnesium, etc.)

By Process / Technology

- Mechanical Processing & Sorting (Shredding, Magnetic/Eddy Current, Optical Sorting)

- Pyrometallurgical (Smelting, Refining)

- Hydrometallurgical / Chemical Recovery (Leaching, Solvent Extraction)

- Electrochemical Recovery / Electrowinning

- Biohydrometallurgy / Biorecovery & Emerging Processes

- Cryogenic & Advanced Separation Technologies

By End-Use Industry

- Automotive (Scrap & Secondary Metals for Casting, Body Parts)

- Construction & Infrastructure

- Electrical & Electronics (including PCBs, connectors)

- Packaging (Aluminum Cans, Foils)

- Aerospace & Defense (high-spec recycled alloys)

- Energy (Wind, Transmission, Battery supply chain)

- Industrial Machinery & Others

By Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Immediate Delivery Available | Buy This Premium Research Report@ https://www.towardschemandmaterials.com/checkout/6007

About Us

Towards Chemical and Materials is a leading global consulting firm specializing in providing comprehensive and strategic research solutions across the chemical and materials industries. With a highly skilled and experienced consultant team, we offer a wide range of services designed to empower businesses with valuable insights and actionable recommendations.

Our Trusted Data Partners

Towards chem and Material | Precedence Research | Statifacts | Towards Packaging | Towards Healthcare | Towards Food and Beverages | Towards Automotive | Towards Consumer Goods | Nova One Advisor | Nutraceuticals Func Foods | Onco Quant | Sustainability Quant | Specialty Chemicals Analytics

For Latest Update Follow Us: https://www.linkedin.com/company/towards-chem-and-materials/

USA: +1 804 441 9344

APAC: +61 485 981 310 or +91 87933 22019

Europe: +44 7383 092 044

Email: sales@towardschemandmaterials.com

Web: https://www.towardschemandmaterials.com/

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.